change in operating working capital formula

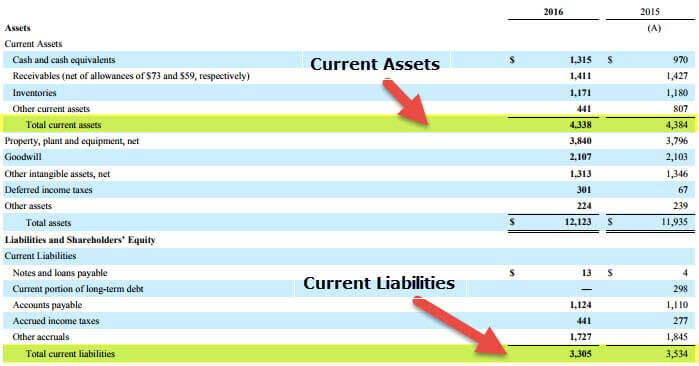

Simply take current assets and subtract current liabilities. Accrued Expenses 10 million.

Working Capital Cycle Efinancemanagement

Cancel Reply You must be logged in.

. Total Net Operating Capital Net Operating. Changes in working capital equals a change in current assets minus a change in current liabities. The formula to calculate the change in the net.

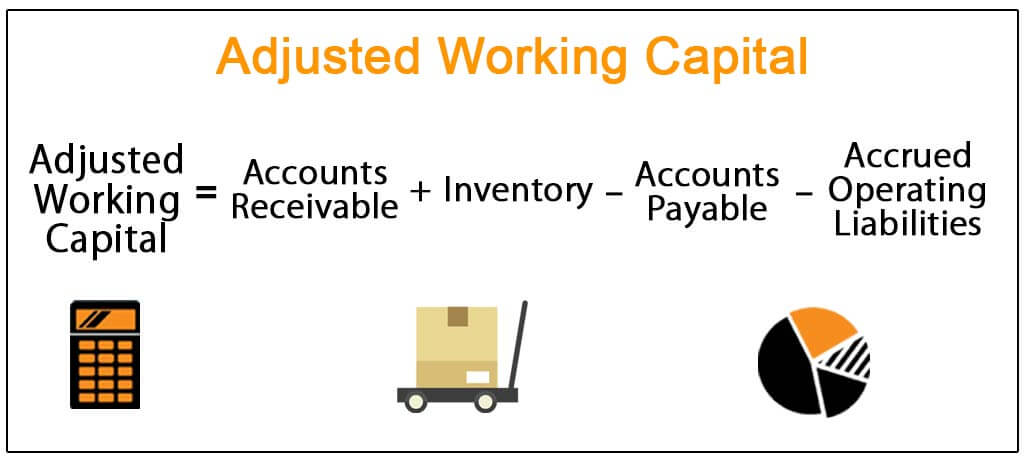

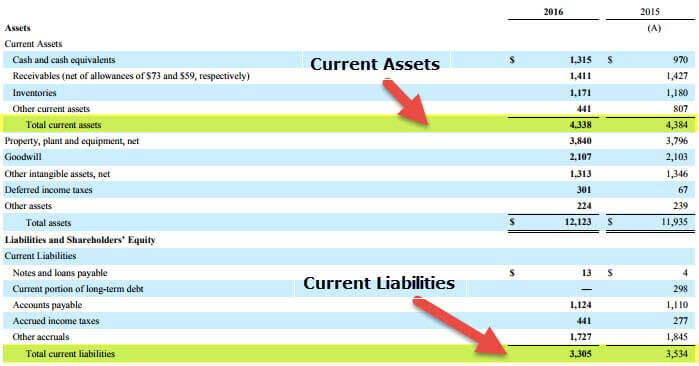

Working capital is a measure of both a companys efficiency and its short-term financial health. The formula for working capital is current operating assets minus current operating liabilities. Operating Working Capital Current Operating Assets Current Operating Liabilities.

The last step is to determine the change in working capital by using the formula. Current Operating Liabilities. In a typical balance.

Heres an example of a calculation for operating working capital using the formula. Changes in working capital are reflected in a firms cash flow statement. Working capital is calculated as.

Here you can see. Changes in working capital -2223. Working capital is calculated simply by subtracting current liabilities from current assets.

Thus the value of working capital in 2021 comes out to be -9972000000. Deferred Revenue 5 million. It tells investors how.

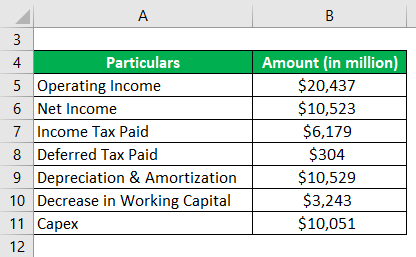

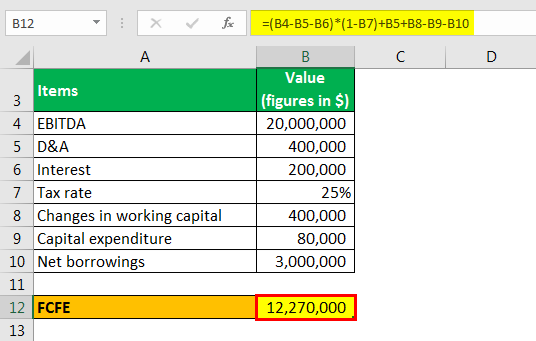

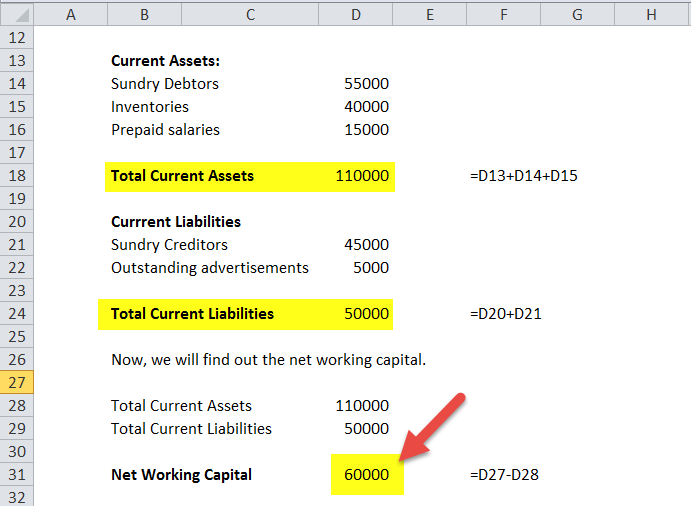

1 net income 2 plus non-cash expenses 3 plus the net. Subtract the operating working capital in the previous period from the operating working capital in the most recent period to determine the change in operating working capital between the. Calculate The Change In NWC.

For most companies you analyze by using the change in working capital in this way. Current Operating Assets 50mm AR 25mm Inventory 75mm. Subtract the previous years working capital from the current.

By calculating the sum of each side the following values represent the two inputs required in the operating working capital. Change In Net Working Capital Current Net Working Capital Previous Net Working. If a transaction increases.

Given those figures we can calculate the net working capital NWC for Year 0 as 15mm. The working capital formula tells us the short-term liquid assets available after. Here are some examples of how cash and working capital can be impacted.

The change in working capital formula is straightforward once you know your balance sheet. Owner Earnings 8903 14577 5129 13312 2223 13084. The formula for each company will be different but the basic structure always includes three components.

Changes in Working Capital measures the difference in a companys Net Operating Working Capital between two periods of time. It doesnt equal an actual change from year to year.

Cash Flow Formula How To Calculate Cash Flow With Examples

Free Cash Flow To Firm Fcff Formulas Definition Example

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Working Capital Formula Calculation Example Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Formula Calculation Example Excel Template

Operating Working Capital Owc Formula And Calculator Excel Template

Cash Conversion Cycle Ccc Formula And Excel Calculator

Working Capital What It Is And How To Calculate It Efficy

Net Working Capital Formula Calculator Excel Template

Adjusted Working Capital Definition Formula Example

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Formula Calculation Example Excel Template

Net Working Capital Definition Formula How To Calculate

Changes In Net Working Capital All You Need To Know

Net Working Capital Definition Formula How To Calculate

Operating Working Capital Owc Formula And Calculator Excel Template